Cameroon’s Socapalm, a subsidiary of Luxembourg-based Socfin, announced on February 18, 2026, that it has sold its “Eséka plantation” in the Center region to Opalm. Sources close to the deal indicate that the agreement primarily concerns the industrial palm oil mill operated by Socapalm at the Eséka site. The transaction amount was not disclosed.

Socapalm, presented as Cameroon’s leading palm oil producer, said the agreement guarantees the protection of employee rights. “The transition is being conducted with a strong commitment to human capital: all current staff will be transferred to Opalm, with full preservation of acquired rights, seniority, positions, and social benefits,” the company said. A source close to the matter added that a “transition bonus” will be paid to employees and noted that the first meeting between Socapalm’s Eséka staff and Opalm’s management took place on February 18, 2026.

The acquisition forms part of Opalm’s broader investment plan. On December 22, 2025, at the Prime Minister’s Office in Yaoundé, company executives signed a CFA45 billion investment agreement with the Cameroonian government for the construction of five palm oil production plants in key production basins across the country.

A 300,000-Ton Annual Palm Oil Deficit

Under Opalm’s initial plan, the first plant was to be built in the Nyong-et-Kellé division, whose capital is Eséka. With the purchase of the existing Socapalm mill, Opalm’s investment will instead focus on modernizing the facility and “tripling its current production capacity,” according to an authorized source.

At the December 2025 signing ceremony, Opalm Chief Executive Officer Tarek Daoud outlined two objectives: supporting the government’s efforts to structure and plan rural development, and increasing national palm oil output. “Cameroon’s current palm oil deficit stands at 300,000 tons. The Opalm program aims to increase available capacity for local industries by 108,000 tons, representing a reduction of about 50%,” he said.

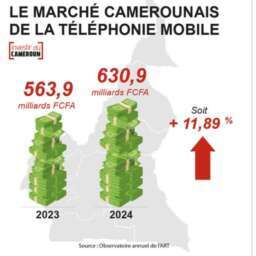

Around CFA100 Billion in Annual Imports

The supply gap directly affects domestic industry. Processing companies in Cameroon — including refined oil producers and soap manufacturers — generally operate at only 40% to 50% of installed capacity. “Thanks to Opalm’s investment, palm oil processing plants could finally run at full capacity,” Agriculture Minister Gabriel Mbairobe said, estimating the country’s oilseed refining capacity at 1.2 million tons.

Beyond industrial output, the project is presented as a way to curb imports, officially estimated at around CFA100 billion per year. These imports contribute to trade imbalances and put pressure on foreign exchange reserves. “Opalm’s project will help the state slightly rebalance the trade balance,” Minister Mbairobe said.

Brice R. Mbodiam