MTN has signed an agreement to acquire the shares of IHS Holding Limited (IHS) that it does not already own, in a transaction fully paid in cash. The South African group announced the deal on February 17.

The proposed price is $8.50 per share, valuing IHS at about $6.2bn in enterprise value (EV), or CFA3,446bn at the February 4, 2026 exchange rate ($1 = CFA555.72818). At that rate, $8.50 equals about CFA4,724 per share.

Enterprise value does not represent the actual cash paid, as it includes debt and cash. The amount announced to acquire the shares MTN does not yet own is $2.2bn (about CFA1,223bn). The offer covers 75.3% of IHS’s share capital. Including MTN’s existing 24.7% stake, the transaction implies an equity value of about $2.9bn (around CFA1,612bn) on a fully diluted basis. If completed, IHS would be delisted from the New York Stock Exchange.

Governance and shareholder backing already secured

IHS’s board of directors has approved the transaction and recommends it to shareholders, according to Wendel, a long-standing minority investor.

On MTN’s side, a SENS announcement refers to current support representing about 40% of voting rights, including MTN’s voting interest and a support agreement signed with Wendel.

Wendel said the offer would allow it to sell its entire stake (about 19%) and that it expects around $535m in net cash proceeds at closing (about CFA297bn). The group highlighted a 21% premium to its last reported NAV as of September 30, 2025. On market metrics, Wendel cited a 36% premium to the 52-week VWAP and a 3% premium to an “unaffected” price of $8.23 as of February 4, 2026.

MTN, for its part, mentioned a 9.7% premium to the 30-day VWAP as of February 4, 2026, the day before its cautionary announcement. Closing is expected in 2026, subject to customary approvals.

MTN seeks to regain control of tower infrastructure

MTN said it intends to regain direct control of passive infrastructure, particularly towers, after years in which the “sale and leaseback” model was widely used.

Chief Executive Ralph Mupita described the transaction as a key step in strengthening MTN’s strategic and financial position, highlighting the opportunity to “buy back our towers.” Wendel referred to a volatile environment, including currency swings, inflation, and energy pressures that have increased lease costs.

MTN also stated that IHS derives about 70% of its revenue from MTN, with an embedded margin in lease payments. IHS Chief Executive Sam Darwish described the offer as providing an “immediate return” to shareholders and said the transaction underscores the strong link between IHS Towers and Africa.

Cash-funded structure and Africa refocus

MTN said it aims to acquire only IHS’s African operations, following planned disposals in Latin America. While IHS is valued at $6.2bn in EV, MTN indicated that deducting $0.5bn for LatAm fiber assets and $0.9bn for LatAm towers would imply a valuation of about $4.8bn (around CFA2,667bn) for the African tower portfolio.

Of the $2.2bn cash consideration, about half ($1.1bn) would come from IHS’s cash available at closing. The remaining amount would be funded by MTN through existing liquidity and debt, with no share issuance.

Two disposals have already been announced. On February 11, 2026, IHS said it would sell 51% of I-Systems, its Brazilian fiber unit, to TIM for an EV of $452.6m (about CFA252bn), covering 9.3 million homes passed and 22,250 km of routes, marking its exit from the Brazilian fiber sector.

For its Latin American tower assets, IHS announced a sale to Macquarie Asset Management at an EV of $952m (about CFA529bn), including lease liabilities, covering operations in Brazil and Colombia with 8,860 sites.

Cameroon exposure and neutrality concerns

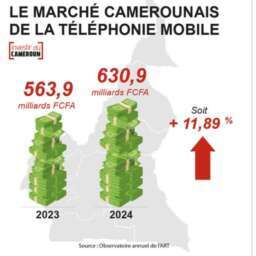

IHS operates more than 37,000 towers across seven markets, including Cameroon. The company reports revenue of $1.8bn (about CFA1,000bn) and an EBITDA margin above 55%.

In Cameroon, MTN could better balance investment decisions, including construction, energy, and network densification, against lease costs in order to manage expenses and operational risks. However, neutrality becomes a central issue. IHS leases towers to multiple operators. If MTN acquires full control, it will need to demonstrate to regulators and competitors that access will remain non-discriminatory, as MTN emphasizes an open-access strategy through its digital infrastructure platform.

Baudouin Enama