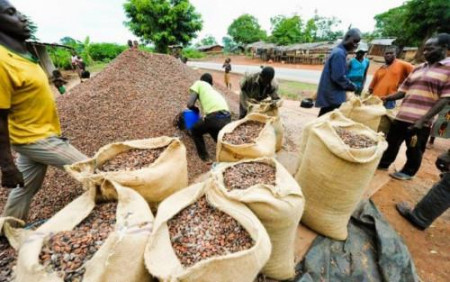

(Business in Cameroon) – The Supply Chain Information System (SIF) managed by the National Cocoa and Coffee Board (ONCC) shows that a kilogram of cocoa beans has traded between CFA2,300 and CFA2,400 at the port of Douala since November 14, 2025, a drop of CFA500 to CFA600. Ten days earlier, prices ranged from CFA2,809 to CFA3,009, already slightly up by CFA150 to CFA170 over the previous week.

The SIF does not specify the causes. It is, however, the most significant drop since August 7, 2025, the official launch date of the 2025-2026 season.

Because port prices are linked to farmgate prices, cocoa farmers are now experiencing a drop in income. The decline comes as producers were expecting, with the end of the rains approaching, a stronger rebound after several weeks of modest increases.

Traditionally, as roads dry at the end of the rainy season, buyers remove the discounts applied to offset logistical surcharges. The current trend threatens to counter this normally favorable seasonal effect.

Public authorities expect average producer prices of CFA3,200 to CFA5,400 per kilogram for 2025-2026. The ongoing correction puts this target to the test.

According to several commodity analysts, the global season is expected to show a surplus of around 186,000 tons. A surplus of this scale exerts downward pressure on international prices, which in turn affects domestic prices and the income of Cameroonian producers.

At the peak of the 2023-2024 season, Cameroonian producers received up to CFA6,300 per kilogram, a level that made local cocoa farmers among the best paid in the world.

The decline highlights the vulnerability of agricultural income to global market conditions, despite seasonal improvements in logistics. In the short term, the priority is to limit the full transmission of external shocks (adjusting discounts, improving collection logistics). In the medium term, stability will depend on quality premiums, more predictable contracts, and lower transaction costs to better smooth price volatility.