(Business in Cameroon) – On June 12, 2025, Cimencam, a company controlled by LafargeHolcim-Maroc Afrique (LHMA), inaugurated its subsidiary Cimencam Figuil (CIMFIG) and a new production line for cement and clinker in Figuil, located in Cameroon’s North Region. Prime Minister Joseph Dion Nguté presided over the inauguration ceremony.

“The Head of State sent me here because of the importance of this event—the inauguration of this plant, which produces not only cement but also clinker. As you know, clinker is essential in cement manufacturing. This is the first plant of its kind in Cameroon. I believe Cameroon’s industrialization is now truly underway,” the Prime Minister said after the ceremony.

Strategic Breakthrough for Local Cement Production

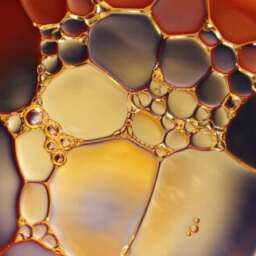

Clinker, a key raw material in cement production, is still largely imported by Cameroonian cement manufacturers. These imports significantly impact the country’s trade balance and are frequently cited as a primary reason for persistently high cement prices in the domestic market, despite the proliferation of cement plants since 2015. Local clinker production, therefore, represents a strategic victory for the entire industry, with the potential to reduce import dependency and lower production costs.

The new CIMFIG line, part of an expansion project at the 40-year-old Figuil cement plant, boasts an annual cement production capacity of 500,000 tons and a daily clinker capacity of 1,000 tons. The investment for this expansion is estimated at CFAF50 billion.

Expansion Beyond Borders: Targeting Chad

“This major industrial project marks a decisive milestone in Cimencam’s development strategy and Cameroon’s reindustrialization. This integrated plant was established to meet the growing demand in the Grand North and also in neighboring Chad,” Cimencam stated in its press release announcing the inauguration.

In practical terms, the upgraded CIMFIG plant is expected to supply cement to Cameroon’s North, Adamaoua, and Far North regions, while also positioning itself to tap into the Chadian market, where frequent shortages and steep prices plague consumers.

In 2024, for instance, Chad’s cement supply chain faced setbacks: the public cement firm Sonacim, undergoing privatization, struggled operationally, and Cimaf Chad—the country’s main producer—reported a 50% year-on-year drop in production. The decline was attributed to logistical bottlenecks in transporting clinker from the Port of Douala.

With local clinker now being produced closer to the border, CIMFIG could offer a more reliable and cost-effective supply chain for Chad’s cement market, potentially reshaping the sub-regional landscape.

Brice R. Mbodiam