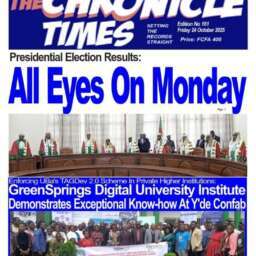

(Business in Cameroon) – Cameroon’s domestic debt reached 3,900.2 billion CFA francs in the first quarter of 2025, according to the Autonomous Sinking Fund (CAA). The public debt manager noted that this figure, which excludes aged payables, represents a 10.9% year-on-year increase and now accounts for 12.1% of the country’s GDP.

The rise in domestic debt underscores the government’s cash flow pressures, leading to financial challenges for companies that have fulfilled public contracts. “The untimely mobilization of anticipated resources has created arrears (RAP) — invoices pending payment at the Public Treasury, Editor’s note — particularly towards state suppliers and companies awarded public contracts, continuing to exert significant pressure on public cash flow and impacting the expenditure chain,” the CAA acknowledged in its public debt status report as of the end of March 2025.

Reliable sources indicate that the volume of the government’s domestic debt and the strategies for its gradual settlement were a concern for the International Monetary Fund (IMF) during its recent mission to Cameroon from April 30 to May 8, 2025. During the 8th review of agreements under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF), as well as the second review of the agreement under the Resilience and Sustainability Facility (RSF), the Bretton Woods institution reportedly suggested that Cameroonian authorities consider taking out a loan for the partial settlement of this debt.

Cameroon’s government had previously secured a loan of 323.9 billion CFA francs in July 2024 from the American Citi Group to alleviate its domestic debt, particularly the RAP. A similar operation could occur this year amidst increasingly challenging financing conditions. “The financing of the economy continues to face several constraints, notably the deterioration of access to financial markets, both nationally and internationally, due to more restrictive refinancing conditions and rising risk premiums,” the CAA observed.

BRM