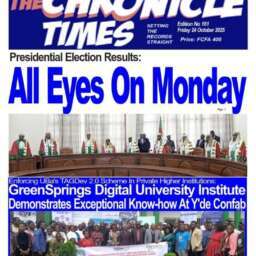

(Business in Cameroon) – Yesterday, Célestin Tawamba, president of the Cameroon Employers’ Association (GICAM), expressed concerns about the country’s ability to meet the goals set in its 2020-2030 National Development Strategy (SND30). Tawamba pointed out that Cameroon’s economic performance has fallen short of targets outlined by the government in both the 2010-2020 Growth and Employment Strategy Paper (DSCE) and SND30.

According to him, the government aimed for an average economic growth rate of 5.5% from 2010 to 2020 and 6.6% from 2021 to 2025. However, Cameroon only achieved 4% growth from 2010 to 2020 and 3.8% from 2021 to 2023. These figures represent gaps of 1.5% and 2.8% respectively. The government has cited the COVID-19 pandemic, which continues to affect many economies worldwide, as one of the main reasons for missing these targets.

Célestin Tawamba also raised concerns about poverty and underemployment, which have worsened over the years. He cited data from the National Institute of Statistics (INS), which shows that the number of Cameroonians living below the poverty line increased by over two million between 2014 and 2021, reaching 10.5 million people by 2021.

A recurring issue raised by Tawamba was Cameroon’s tax system, which he described as “confiscatory” due to the heavy tax burden on businesses. He explained that formal sector companies pay effective tax rates of 60% to 80%, and even loss-making or newly established businesses are taxed. He also criticized frequent tax and customs audits, which often result in large fines that exceed the profits or even revenue of companies.

Despite his criticisms, Tawamba acknowledged some positive developments, such as the digitization of tax procedures, which has made things easier for taxpayers. He also welcomed the reduction in corporate tax rates for small and medium-sized enterprises (SMEs), as well as improvements in customs procedures and the introduction of incentive measures to promote import substitution.

Tawamba called for a “tax pause” in 2025, advocating for economic recovery policies that would expand the tax base without placing additional burdens on already heavily taxed companies. He also suggested reforms to property taxes and other fiscal measures.

The GICAM president further addressed the issue of brain drain, with a large number of skilled Cameroonian workers emigrating to countries like Canada. From January to April 2024 alone, nearly 6,000 Cameroonians moved to Canada. This ongoing migration, which has been rising for over two decades, poses a threat to the competitiveness of local businesses, as many of these workers have received continued education and training from their employers. Tawamba emphasized that the loss of skilled workers is having a significant impact on the national economy and the labor market.