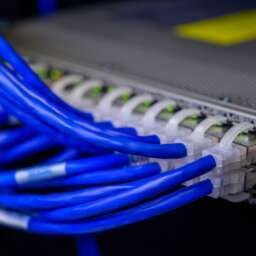

(Business in Cameroon) – Cameroon’s telecommunications sector significantly increased its investment effort in 2024. According to the Electronic Communications Market Observatory published by the Telecommunications Regulatory Agency (ART), total investment declared by all operators reached CFA194.49 billion, up 35.49% from the roughly CFA143.5 billion recorded in 2023. In absolute value, nearly CFA50.9 billion in additional investment was injected into the sector over one year.

This momentum reflects sustained efforts to modernize networks and infrastructure. Yet behind the overall increase, the distribution of investment reveals stark contrasts between market segments.

A surge driven by concession operators

The headline growth masks a deep imbalance in investment structure. Concession operators—MTN Cameroon, Orange Cameroun, and Camtel—account for more than 91% of total investment, with their spending rising by more than 41% in one year. Mobile network expansion and associated infrastructure continue to drive the bulk of sector investment.

By contrast, other market segments show a sharp downturn. Operators holding first-category licenses (excluding passive infrastructure providers) saw their investment fall by 55.87%. The ART report notes: “The imbalance between segments may reflect increased dependence on mobile infrastructure at the expense of service diversity. It would be useful to conduct studies on the economic, regulatory, and strategic levers that could stimulate investment in the less dynamic segments of the telecommunications sector, particularly Internet service providers, passive infrastructure operators, and entities holding prior-declaration receipts.”

This concentration of financial flows among legacy mobile operators raises questions about the sector’s ability to diversify digital services and support new business models.

Quality of service: investment under regulatory pressure

Despite high investment levels, network quality remains under intense scrutiny. On July 2, 2025, the ART imposed new fines totaling CFA2.6 billion on MTN and Orange Cameroun for persistent failures to meet quality-of-service obligations. The regulator cites network coverage rates that fall short of required thresholds.

The ART also highlights shortcomings related to pricing practices, particularly failures in the codes used to unsubscribe from value-added services. These issues contribute to what users commonly call “credit theft,” in which communication credits are deducted for services that subscribers did not actually sign up for.

These sanctions illustrate growing tension between rising investment and, on the other hand, consumer and regulatory expectations for service quality, transparent pricing, and user protection.

Amina Malloum