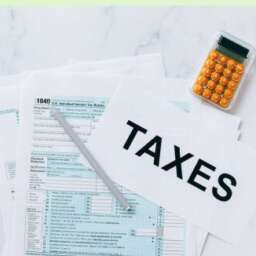

(Business in Cameroon) – The government is set to tap the sub-regional public securities market, next Monday, to raise a total of 70 billion CFA Francs. This financing drive will be executed through its 22 licensed banks, designated as Primary Dealers (SVTs), according to the Bank of Central African States (BEAC).

The fundraising effort will involve two Treasury bill (BTA) issues and one assimilated Treasury bond (OTA) issue. Specifically, the Cameroonian Treasury plans to secure 40 billion CFA Francs from investors via two BTA issues, each targeting 20 billion CFA Francs with maturities of 26 and 52 weeks, respectively. The same day, the Treasury will issue 5-year OTA bonds, offering a yield of 6.75%, to raise an additional 30 billion CFA Francs.

These three operations follow a rather favorable period for Cameroon on the public securities market, which is organized by the BEAC, the central bank for the CEMAC countries (Cameroon, Congo, Gabon, Equatorial Guinea, Chad, and Central African Republic). On May 19, 2025, Cameroon successfully conducted two BTA issues with 26 and 52-week maturities, collectively raising approximately 32 billion CFA Francs out of the 40 billion CFA Francs sought.

While the May 19 issuance could have garnered more funds, the BEAC data indicates that Cameroon, the economic powerhouse of the CEMAC region, continued its strategy of emphasizing relatively low interest rates. For its 52-week BTA issue, for instance, investors offered up to 22.5 billion CFA Francs for the 20 billion CFA Francs targeted. However, the country opted to accept only 17.5 billion CFA Francs, primarily due to the high interest rates demanded by certain subscribers to this government bond.

Since its inception in December 2011, the BEAC public securities market has emerged as a primary funding source for the Cameroonian state. As of March 31, 2025, Cameroon’s outstanding debt on this market stood at an estimated 2,153 billion CFA Francs, according to the latest figures from the Autonomous Sinking Fund (CAA), Cameroon’s public debt manager.

BRM