(Business in Cameroon) – Cameroon is preparing a direct loan of CFA250 billion from local banks, backed by a guarantee from the African Export-Import Bank (Afreximbank), as part of an upcoming revised finance bill for the 2025 national budget. This information is detailed in the 2026–2028 Medium-Term Economic and Budgetary Programming Document, which supported the 2025 Budget Orientation Debate at the National Assembly.

With this loan, the government plans to nearly double its initial 2025 bank borrowing target. The total envelope for domestic bank loans would increase to CFA440.1 billion, compared to CFA220.6 billion set in the original finance law adopted in November 2024. The revised budget is expected to be submitted soon for parliamentary review and approval.

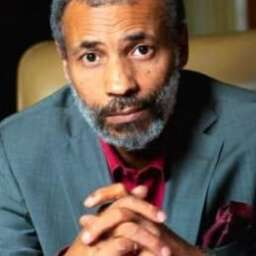

If passed, this would mark the second time in 2025 that Cameroon partners with Afreximbank to secure state financing. On June 30, 2025, the pan-African bank—now led by Cameroonian legal expert George Elombi—enabled the Treasury to raise CFA200 billion on the BEAC-led CEMAC public securities market.

That deal was structured through a currency swap, where Afreximbank converted euros into CFA francs at the BEAC, allowing it to subscribe to Treasury bonds (OTAs) issued by Cameroon. The bonds had maturities of 3, 4, 5, 6, and 7 years, with interest rates ranging from 6.5% to 7.5%.

The successful transaction made Afreximbank the first foreign financial institution to operate on the CEMAC public securities market, which includes Cameroon, Congo, Gabon, Equatorial Guinea, Chad, and the Central African Republic. This milestone could boost the appeal of the regional money market by attracting more international investors, as local demand is nearing saturation due to heavy state borrowing across the zone.