(Business in Cameroon) – Cameroon’s Treasury recently faced a difficult situation on the public debt market of the Bank of Central African States (BEAC). On November 27, the government was expected to raise CFA14 billion to repay maturing debt. As usual, Cameroon issued new bonds to raise the needed funds. However, the country only managed to secure CFA4 billion.

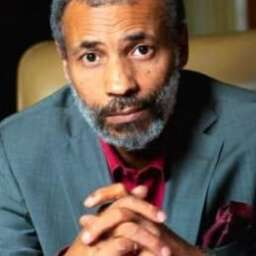

This shortfall forced Cameroon to take CFA10 billion from its own resources to complete the repayment and protect its creditworthiness, which has been one of the most reliable on the market since it was introduced in 2011. These details were shared on the same day by Samuel Tela, the Director of Treasury at the Ministry of Finance, during the “Finance Week” event in Yaoundé. The event brought together finance leaders from across the Cemac region to discuss the importance of domestic capital markets for regional growth. Tela expressed his concerns: “Before, I had an exciting job. Recently, it has become stressful. We used to easily raise resources on the market. Today, we’re struggling to refinance our debt,” he said, referring to the failed refinancing operation mentioned earlier.

Tela’s comments come after a warning from Cameroon’s Minister of Finance, Louis Paul Motazé, in early 2023. During a February 16, 2023v, event in Douala where Cameroon’s financing program for the 2023 fiscal year was presented, Motazé had already expressed concerns about the lack of interest from authorized banks known as Primary Dealers (SVTs) in participating in the government’s fundraising operations on the BEAC market.

Payment Defaults

Motazé criticized some SVTs for not participating in any bond issuance over the past six months. “Out of a network of more than 20 SVTs, 90% of the bond holdings are concentrated in the hands of just five major players,” he noted. In other words, while Cameroon had a network of 20 banks to help mobilize the needed funds, only five banks were actively involved, and the rest were reluctant to engage in Cameroon’s fundraising efforts.

According to Tela, the situation has worsened in recent times. Despite Cameroon previously succeeding in its fundraising operations on the BEAC market with a limited number of SVTs, the country is now struggling to raise the necessary funds. For 13 years, Cameroon had never missed a payment on the BEAC market, a reflection of its solvency and strong credit standing.

High Interest Rates

During the 2023 financing program presentation in Douala, Ministry of Finance officials pointed to the higher interest rates offered by other Cemac countries as a factor contributing to the lack of interest in Cameroon’s bonds. Although Cameroon has increased the interest rates it offers to investors, it remains one of the countries with the lowest returns in the BEAC market.

“We try to explain to the banks, the SVTs, that the goal is not to chase interest rates of 7% in other countries. They need to also consider the risks. Our short-term bonds are around 4%. But there are countries in Cemac offering up to 7%,” explained Sylvester Moh, Director General of Treasury at the Ministry of Finance, in February 2023. “The same issue is seen with long-term bonds, where there are huge discounts. For instance, a 7% rate is advertised, but behind it, there are very high discounts. This undermines transparency and the entire system.”

According to BEAC data, Cameroon, once the dominant player on the public debt market, is now being outpaced by Congo and Gabon. These two countries have become more aggressive on the market by offering more attractive interest rates. This has led investors to flock to their bonds, despite the frequent payment defaults, especially in at least one of these countries.