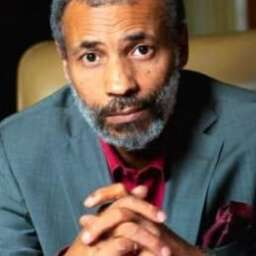

(Business in Cameroon) – In an exclusive interview with Business in Cameroon, Henri-Claude Oyima, CEO of BGFI Group, shared new details about the company’s plans to go public on the Central Africa Stock Exchange (BVMAC). According to Oyima, the initial public offering (IPO) will involve a maximum of 10% of the bank’s capital. This announcement follows his earlier remarks at the inauguration of BGFI’s new headquarters in Cameroon.

Oyima explained the reasons behind the timing of this IPO. Initially planned for 2020, the pandemic caused the board of directors to delay the operation due to uncertainty and fear in the market. “The decision was made to proceed with this significant step when the environment became more stable,” he said.

BGFI is now nearing the end of its five-year strategic plan, “Dynamic 2025,” during which it exceeded many of its performance targets. Listing the group on the stock exchange was a key element of this strategy. Oyima, also chairman of the BVMAC board, emphasized the importance of leading by example as the exchange encourages major companies in the CEMAC region to energize the financial market.

The exact structure of the IPO has yet to be determined. It could involve issuing new shares to attract fresh investors or selling existing shares held by current shareholders.

The largest shareholder in BGFI is Nahor Capital, an investment company owned by Oyima’s family, holding 27% of the group’s capital. Other shareholders include Delta Synergies, an investment entity linked to the Bongo family, with a 10% stake. The Bongo family’s political departure has positioned them as private investors, making BGFI a privately owned financial group.

BGFI Group will present a robust financial profile to attract potential investors. From 2019 to 2023, its net banking income increased from CFA175 billion to CFA302 billion (approximately $492 million). During the same period, its net profit rose from CFA20.5 billion to CFA95.8 billion. The group also improved operational efficiency, reducing its cost-to-income ratio from 79% to 65%.

BGFI’s targets for 2025 include a total balance sheet of CFA6,000 billion, customer deposits of CFA4,000 billion, customer loans of CFA3,500 billion, net banking income of CFA363 billion, and consolidated net profit of CFA130 billion.

The 2024 financial results will be closely watched, as they are expected to show the impact of BGFI’s recent acquisition of Société Générale’s former subsidiary in the Republic of Congo.

The price of BGFI shares during the IPO is yet to be announced. Once the listing is finalized, BGFI will become the eighth company in the stock exchange’s equities section and the third Gabon-based company to join this regional financial platform. This development will further enhance the growth and dynamism of the regional stock market.