The heads of state and government of the Economic and Monetary Community of Central Africa (CEMAC) have agreed on a new set of economic measures aimed at stabilising the sub-region’s fragile macroeconomic position, following an extraordinary summit held in Brazzaville, Republic of Congo. Meeting at Kintele under the chairmanship of Congolese President Denis Sassou Nguesso, the leaders resolved to accelerate negotiations and implementation of economic and financial programmes with the International Monetary Fund (IMF), fast-track the repatriation of foreign exchange earnings, and step up the community’s import-substitution strategy. The decisions were taken against a backdrop of persistent fiscal deficits, pressure on external reserves, and concerns over the sustainability of public debt, despite signs of modest but positive economic growth across the six-member bloc.

According to figures presented during the summit, CEMAC’s economic growth rate is projected at about 3 per cent in 2026, up from 2.7 per cent in 2025, while inflation has trended downward and fallen below the community threshold of 3 per cent. However, leaders noted that these gains remain insufficient to restore macroeconomic balance.

The regional fiscal deficit is forecast to widen to 3.1 per cent of gross domestic product in 2026, while uncontrolled capital outflows and declining foreign exchange reserves continue to weigh on the external position. Reports delivered by the Governor of the Bank of Central African States (BEAC) and the President of the CEMAC Commission highlighted the urgency of stronger fiscal discipline, improved public finance management and closer alignment between national budgets and IMF-supported programmes to safeguard debt sustainability and monetary stability.

In his closing address, President Denis Sassou Nguesso stressed the need for decisive action, stating: “We must diversify our economies further, accelerate the pace of structural reforms in governance, budgetary discipline, improvement of the business climate and deepening of regional integration.” He added that, given the gravity of the situation, member states had committed to implementing past and current resolutions “resolutely”.

The summit also heard from Cameroon’s Minister of Finance, Louis Paul Motaze, representing President Paul Biya, who reiterated earlier positions on debt management. “Debt is not a problem in itself,” Motaze said. “The problem is debt sustainability. How do we borrow without strangling public treasuries? When we calculate the debt ratio, there is the debt, and there is wealth, meaning GDP.” IMF representatives at the meeting welcomed the proposed measures and encouraged member states to consolidate public finance management within a coordinated regional framework.

Beyond short-term fiscal adjustment, the Brazzaville commitments place strong emphasis on structural transformation to reduce the region’s long-standing dependence on imports and volatile commodity revenues. In the medium term, member states agreed to strengthen and clean up the banking sector, reduce banks’ exposure to sovereign risk, and reinforce the Development Bank of Central African States’ (BDEAC) role in financing structural transformation.

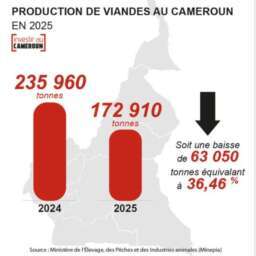

The summit also called for faster implementation of the community import-substitution strategy, including local value addition and industrialisation. The Director of the United Nations Economic Commission for Africa’s Central Africa office, Jean-Luc Mastaki, underscored this priority, saying: “Unless we diversify and produce locally, add value locally and effectively implement import substitution, we will remain vulnerable.”

To ensure follow-through, leaders instructed that the Secretariat of the Economic and Financial Reform Programme (PREF-CEMAC) be strengthened to conduct quarterly evaluations, with the first-quarter 2026 report to be completed ahead of the IMF and World Bank Spring Meetings.

Mercy Fosoh