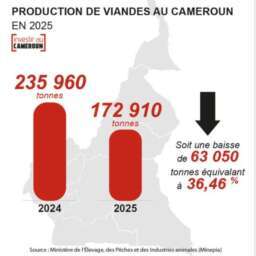

- (Business in Cameroon) – Card payments in Cameroon totaled CFA149.8 billion in 2023, just 6.5% of CFA2.28 trillion processed through mobile money.

- The country recorded 24.86 million mobile money accounts versus only 1.4 million bank cards in circulation.

- There were 944 ATMs nationwide compared to just 1,739 electronic payment terminals (POS).

In 2023, Cameroonian bank cardholders carried out 1.6 million merchant transactions totaling CFA149.8 billion, the Bank of Central African States (BEAC) said in its latest report on payment services across the Central African Economic and Monetary Community (CEMAC), which includes Cameroon, Congo, Gabon, Equatorial Guinea, Chad, and the Central African Republic.

The data shows that card transactions accounted for only 6.5% of the CFA2.28 trillion processed via electronic money in Cameroon during the same period. The vast majority of these payments were conducted through mobile money services operated by telecom companies in partnership with banks. These platforms enable users to deposit, withdraw, transfer funds, and make payments for goods, services, taxes, and microloans directly from their mobile phones.

BEAC’s findings highlight the crucial role of mobile money in driving financial inclusion across the CEMAC region, particularly in Cameroon. Unlike bank cards, which remain accessible mainly to the formally banked population—estimated at 40%, including microfinance clients—mobile money services are easy to use and widely available. Their popularity stems from a mobile phone penetration rate exceeding 80%, enabling rapid adoption among both urban and rural consumers.

As a result, Cameroon counted only 1,739 point-of-sale terminals (POS) in 2023, compared with 24.86 million registered mobile money accounts. Of these, 11.7 million were active, facilitating transactions at hundreds of thousands of merchants that accept mobile payments nationwide. Mobile accounts are also free to maintain, while bank cards typically carry issuance and maintenance fees.

Although underused for payments, bank cards in Cameroon remain popular for cash withdrawals. BEAC reported CFA3.5 trillion in ATM withdrawals in 2023, underscoring the persistence of cash-based transactions. The country hosted 944 automated teller machines (ATMs) out of the 2,015 recorded across the CEMAC region, compared with only 1,739 POS terminals available for in-store electronic payments.

This article was initially published in French by Brice R. Mbodiam

Adapted in English by Ange Jason Quenum